how does maine tax retirement income

Social Security is exempt from taxation in Maine but other. However that deduction is reduced in an amount equal to your annual Social.

Virginia Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Increased the exemption on income from the state teachers retirement system from 25 to 50.

. Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income. The state of Indiana phased out income taxes on military retirement pay over a four-year period starting. Take-Home Pay These are the taxes owed for the 2021 - 2022 filing season.

Total Income Taxes. See below Pick-up Contributions. You will have to.

Military retirement pay is exempt from taxes beginning Jan. Retirement income The Back Story. 58 on taxable income less than 22450 for single filers.

The Pension Income Deduction. For questions on filing income tax withholding returns electronically email the Withholding Unit at withholdingtaxmainegov or call the Withholding line at 207 626-8475 select option 4. You may exempt up to 8000 from any income source if youre age 65 or older and.

The exemption increase will take place starting in January 2021. The income tax rates are graduated with rates ranging from 58. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a.

To enter the Pension. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. A manual entry will be made using the Maine State wages found in Box 14 of 1099-R.

Less than 44950 for joint filers High. 3 Is Maine tax friendly to retirees. All out-of-state government pensions qualify for the 8000 income exemption.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Retirement account contributions have special tax-favored status. Maine Income Tax Range.

If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation. Maine allows for a deduction of up to 10000 per year on pension income. The 10000 must be reduced by all taxable and nontaxable social.

On the other hand if you. If you believe that your refund may be. For tax years beginning on or after January 1 2016 benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax.

Subtract the amount in Box 14 from. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax. 1 Does the state of Maine have high taxes.

The US Congress voted and approved in 1978 Title 26 US. 715 on taxable income of 53150 or. 2 Why are Maines taxes so high.

June 6 2019 239 AM. Whatever Your Investing Goals Are We Have the Tools to Get You Started. For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov.

View Of Austin Texas Downtown Skyline Austin Skyline Skyline Downtown

About Ebsa United States Department Of Labor Retirement Calculator Retirement Calculator Department Financial Planning

The Harsh Reality For People With Disabilities Work And Struggle To Afford Medicine Or Stay Home And Struggle To Live Is Disability How To Apply Incentive

Eat Sleep Do Taxes Funny Cpa Accountant Gift Tax Essential T Shirt By Alexmichel Taxes Humor Income Tax Humor Tax Season Humor

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Living In The Round Yurt Living Yurt Home Yurt Interior

States That Won T Tax Your Retirement Distributions Retirement Fund Retirement Budget Retirement

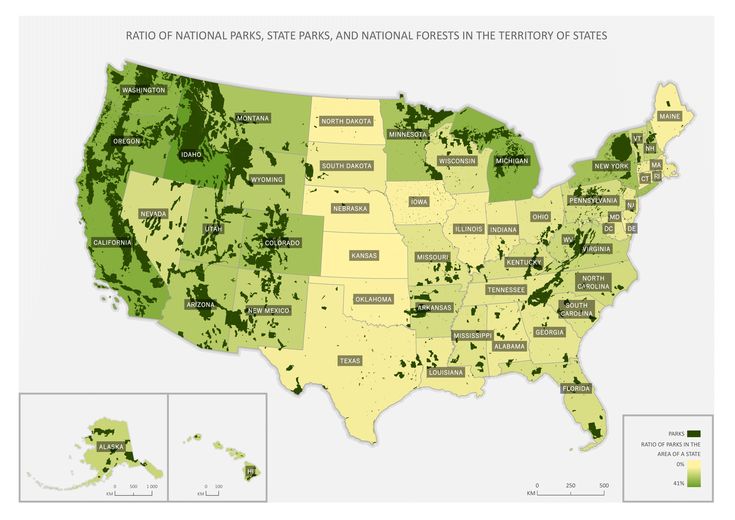

States Rated The By Share Of Parks In Their Territory National Parks American National Parks Us National Parks

State By State Guide To Taxes On Retirees Kiplinger American History Timeline States And Capitals Funny Retirement Gifts

Incometax2020 Itr Income Tax Tax Refund Tax Services

Maine Dor Sales Use Tax Internet Filing Quickbooks Tax Internet

The Georgia Homes Group On Twitter Conventional Loan 30 Year Mortgage Home Buying Tips

Pin On Nutrition And Fitness Did You Know

Helpful Tax Tips Taxes Fact How To Plan Tips Slow Down

Credit Card Debt Is Bad For More Than Just Your Finances Credit Cards Debt Credit Card Balance Financial Counseling

Get What S Yours For Medicare Maximize Your Coverage Minimize Your Costs Medicare Money Book Affordable Health Insurance